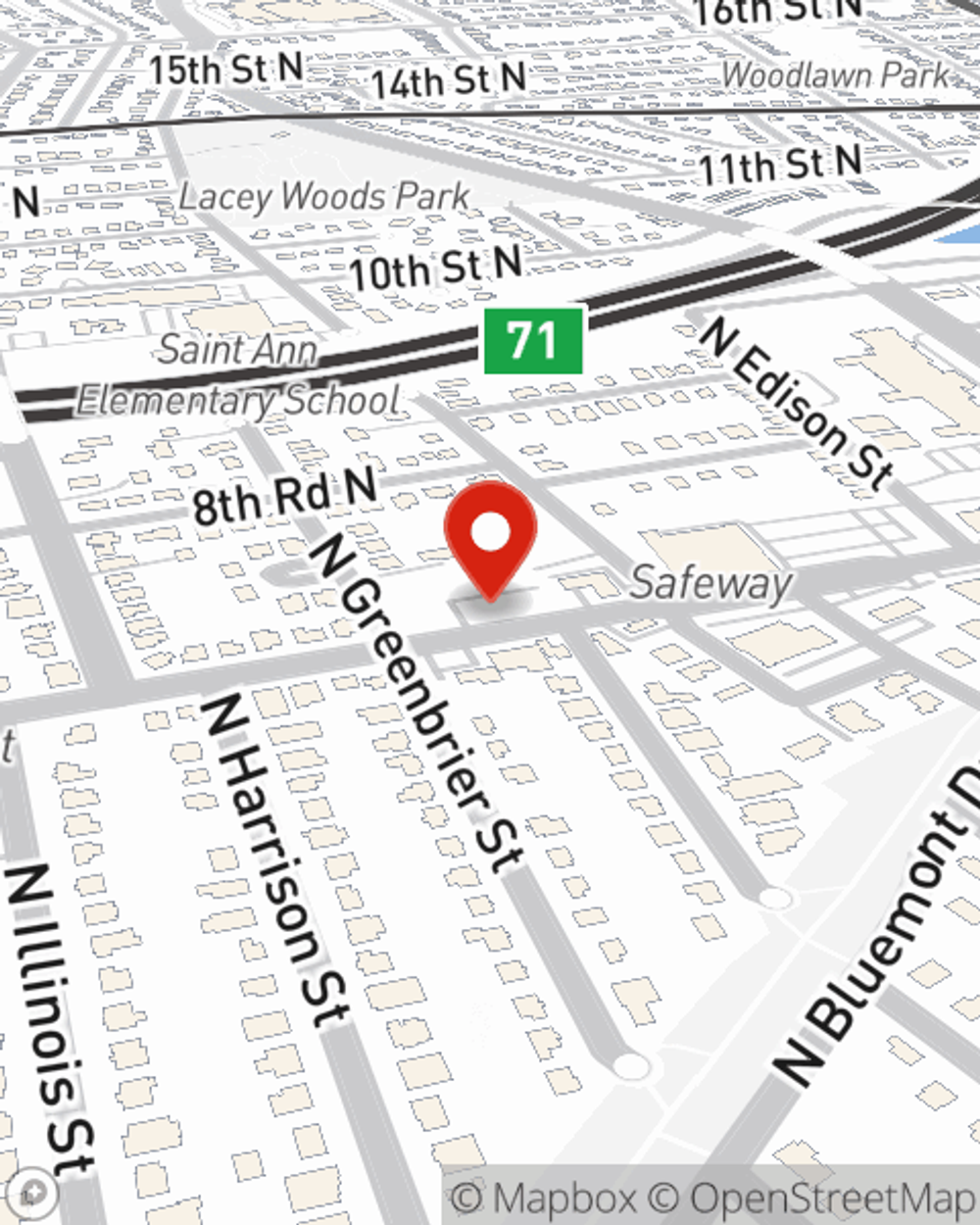

Renters Insurance in and around Arlington

Renters of Arlington, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Arlington

- Arlington County

- Fairfax County

- Alexandria

- City of Alexandria

- Fairfax

- Falls Church

- Mclean

- Vienna

- Chantilly

- Tysons

- Merrifield

- Annandale

- Springfield

- Burke

- Reston

- Herndon

- Oakton

- Sterling

- Ashburn

- Leesburg

- Great Falls

- Manassas

- Woodbridge

Calling All Arlington Renters!

Home is home even if you are leasing it. And whether it's a condo or a house, protection for your personal belongings is a wise idea, even if you think you could afford to replace lost or damaged possessions.

Renters of Arlington, State Farm can cover you

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

It's likely that your landlord's insurance only covers the structure of the apartment or condo you're renting. So, if you want to protect your valuables - such as a recliner, a set of golf clubs or a set of cutlery - renters insurance is what you're looking for. State Farm agent Kenya Knight has the knowledge needed to help you understand your coverage options and protect your belongings.

A good next step when renting a residence in Arlington, VA is to make sure that you're properly protected. That's why you should consider renters coverage options from State Farm! Call or go online now and find out how State Farm agent Kenya Knight can help you.

Have More Questions About Renters Insurance?

Call Kenya at (703) 241-2886 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Kenya Knight

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.